Can I Make Money Renting My Property in Costa Rica?

On a bright January morning, a family from Denver unlocked the front door of their ocean-view condo in Playa Hermosa, Guanacaste. They weren’t residents, nor friends of the owner—they were Airbnb guests, the third group that month. Meanwhile, the property’s owner, sipping coffee 3,000 miles away in Toronto, opened her property management app to see a satisfying notification: another week booked, another deposit pending. Welcome to the new reality of buying a rental property in Costa Rica.

The Allure of the Papagayo Region

Costa Rica has long been a magnet for tourists, retirees, and second-home seekers, but few areas draw interest quite like the Papagayo region. Anchored by destinations like Playas del Coco, Playa Hermosa, Playa Panama, and Playa Ocotal, this stretch of Guanacaste's Pacific coast offers reliable sunshine, easy access via the Liberia International Airport, and a well-developed infrastructure for high-end tourism. For would-be landlords, that matters.

Unlike more remote or underdeveloped areas, Papagayo is fully plugged into the global vacation rental market. There’s a mature network of property managers, cleaning crews, landscapers, and booking services—all of which make it possible to own and operate a rental property without ever living there full-time. And with occupancy rates consistently high during the dry season (December to April) and solid shoulder-season activity, many investors find the potential ROI for a rental property in Costa Rica more compelling here than in any other region.

What Kind of Income Can You Expect?

What Kind of Income Can You Expect?

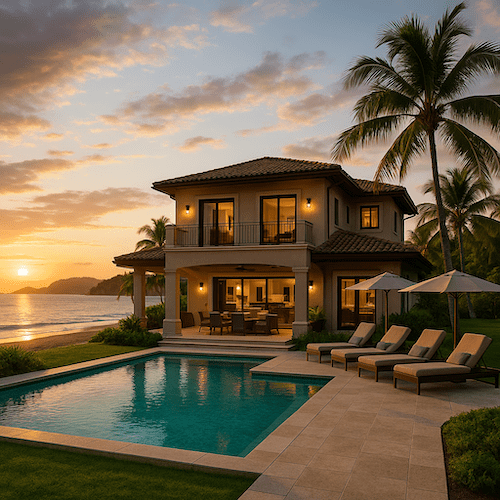

The short answer: it depends—but the numbers are often better than you'd expect. Condos within walking distance to the beach in Playas del Coco or Playa Hermosa can earn between $2,500 and $6,000 per month during high season, especially if they’re well-furnished, have a pool, and offer views. Luxury villas and multi-bedroom homes can command far more—sometimes exceeding $10,000 monthly in peak months.

The key variable is occupancy. Properties that maintain a 60–70% annual occupancy rate and are priced well relative to their amenities often outperform more passive investments back home. But getting there requires more than just listing your place on Airbnb. Responsive communication, good reviews, and professional photos make a substantial difference. That’s where local property management companies come in—they can handle everything from guest check-in to emergency plumbing fixes for roughly 20–30% of gross rental revenue.

The Case for Long-Term Appreciation

While the income potential is strong, many buyers are equally motivated by long-term appreciation. Papagayo is not a speculative market in the way some emerging beach towns are. It has staying power. Values have steadily increased over the past two decades, driven by foreign investment, rising tourism, and government commitment to eco-conscious development.

What’s more, inventory in this region is constrained. There’s limited buildable land near the coast, and new developments face rigorous permitting processes. That scarcity, combined with rising demand from North Americans seeking both investment properties and lifestyle homes, creates a natural upward pressure on prices. In other words, even if rental income only covers your costs in the early years, the asset itself may appreciate in ways that beat inflation and diversify your portfolio.

Know Before You Buy

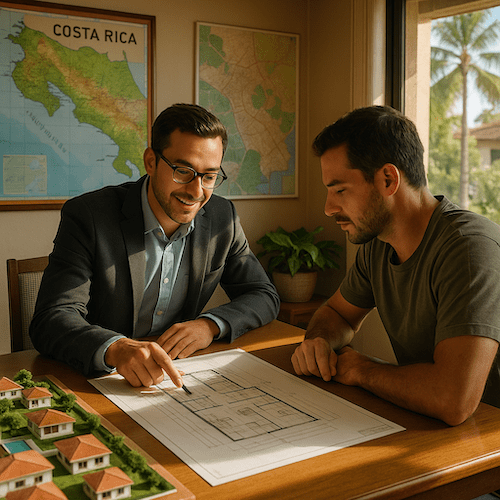

Of course, not every rental story is a success. Some owners underestimate ongoing maintenance costs or overestimate demand in the low season (May to November). Others fail to properly insure their properties or navigate Costa Rica’s regulatory landscape. It’s crucial to work with a reputable agent who understands both local zoning and the rental market, especially if you plan to rent your home while abroad.

Also, be aware of how different property types perform. Condos with HOA fees might have lower maintenance hassles, but those fees can eat into profit margins. Single-family homes offer more flexibility but come with greater upkeep responsibilities. And location still reigns supreme—a modern condo a five-minute walk from Playa Hermosa will outperform a larger house that’s a 15-minute drive from the beach.

So—Can You Make Money?

Yes, you can make money renting a property in Costa Rica, especially in the Papagayo region—but it’s not a passive investment. Success depends on smart property selection, realistic income projections, and good partners on the ground. Many foreign owners cover their costs and then some, with the added bonus of having a beachfront retreat they can enjoy several weeks a year.

If you're buying a rental property in Costa Rica purely for ROI, approach it like a business. But if you're looking for a hybrid investment—one that offers both lifestyle perks and long-term financial upside—Papagayo is hard to beat. It's one of the few places in the world where turquoise water, strong returns, and sunset cocktails all come with the same key.